LOL

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BIT COIN (S)

- Thread starter bol-uk

- Start date

- Status

- Not open for further replies.

orly

Please check with me for Blammo criteria

Not to mention when all these late 20s - early 30s "multi millionaires" try and cash out and put the cash back into the standard economy....

Crash the environment and the global economy on a super steriod charged greedfest.

Kev The Rat

Player Valuation: £70m

Actually on the verge of retirement now. Well once it hits 20k gbp. Which it will.

Kev The Rat

Player Valuation: £70m

I actually think these dips will become fewer and fewer as people stop taking them seriouslySold all my BTC, ETH, and LTC pretty close to their ATH yesterday. Waiting to buy back now on the dip. Made a very tidy profit

orly

Please check with me for Blammo criteria

I've seen this term a lot recently and mining, what is mining?

The process by which Bitcoins are generated.

Thoroughly recommend reading this http://archive.is/kjuLi

BernieH

Player Valuation: £35m

The process by which Bitcoins are generated.

Thoroughly recommend reading this http://archive.is/kjuLi

Oh, thank you very much young man.

I started reading it, it's quite a long article, I shall have to go back when I have more time.

Last edited:

orly

Please check with me for Blammo criteria

Oh, thank you very much young man.

I started reading it, it's quite a long article, I shall have to go back when I have more time.

Yes it is really long mate but a cracking read.

Tulip mania, and not only that, people putting their money into things they do not understand.

As always, some will get fantastically rich. Others will get themselves wiped out.

BernieH

Player Valuation: £35m

Yes it is really long mate but a cracking read.

Tulip mania, and not only that, people putting their money into things they do not understand.

As always, some will get fantastically rich. Others will get themselves wiped out.

Obviously, forgive my ignorance as I haven't read your article yet but BITCOIN can become real currency(in simple terms?)

Kev The Rat

Player Valuation: £70m

no mate its something you dont understand. its made a lot of people very rich indeed, including me.Yes it is really long mate but a cracking read.

Tulip mania, and not only that, people putting their money into things they do not understand.

As always, some will get fantastically rich. Others will get themselves wiped out.

history is written for winners.

did tulip mania even happen?

i see a bubble in fiat money and housing....

orly

Please check with me for Blammo criteria

no mate its something you dont understand. its made a lot of people very rich indeed, including me.

I'm sure it has Kev. I'm sure it has.

As always, some will get fantastically rich. Others will get themselves wiped out.

What do you think will happen to the people who have bought in at the top of the mania period of the last four months when we get another Mt.Gox episode?

history is written for winners.

lol

I've got no issue at all with speculative people who bought in 2011-2013 and have survived exchanges going down, theft and long periods of good rather than bubble-driven growth. They will cash out now and being very rich indeed.

Why do you think the price has done what it has Kev?

did tulip mania even happen?

lordy lordy lordy

Last edited:

Kev The Rat

Player Valuation: £70m

The money comes from a wide variety of sources now not just China as was the case then.I'm sure it has Kev. I'm sure it has.

What do you think will happen to the people who have bought in at the top of the mania period of the last four months when we get another Mt.Gox episode?

Anyway back to tulips - you and I have no idea whether such a thing did in fact occur.

But We can see a mania in fiat and housing before our very eyes.

orly

Please check with me for Blammo criteria

The money comes from a wide variety of sources now not just China as was the case then.

Anyway back to tulips - you and I have no idea whether such a thing did in fact occur.

But We can see a mania in fiat and housing before our very eyes.

Anyway back to tulips - you and I have no idea whether such a thing did in fact occur.

Just the historical evidence, like. But ok.

But We can see a mania in fiat and housing before our very eyes.

Two problems with this statement:

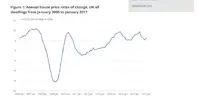

- House price growth, while yes approaching mania levels currently, is fairly cyclical.

- It's a tangible, regulated asset. You can live in it, a fairly important part of general existence, regardless of its overall value.

Just a quick question then Kev. Because you can't buy a huge amount yet with your Bitcoin, and let's face, the big investor willy wangling is all about when you get to change it back into those tangible pounds and dollars, what happens to the money?

I think we are going to see lots of late 20s - early 30s youngsters who saw the odd article on their gaming website in 2011 buying big houses and fast cars.

And that's fine too.

The money comes from a wide variety of sources now not just China as was the case then.

It certainly does mate, lots of late to the party speculators looking to be able to join the conversation in the pub, or perhaps ride one last wave for a quick 2%.

We've seen it alllllllllll before.

Last edited:

Kev The Rat

Player Valuation: £70m

You’re ignoring the damage that unbridled fiat currency printing has done to people and the reality is that bitcoin is a reaction to that. Why do you think it’s always bankers warning against the dangers of bitcoin?Just the historical evidence, like. But ok.

View attachment 42666

Two problems with this statement:

Would I criticise anyone for buying a speculative property in March 2009 and selling it mid-2016? Of course not. And that's the same here.

- House price growth, while yes approaching mania levels currently, is fairly cyclical.

- It's a tangible, regulated asset. You can live in it, a fairly important part of general existence, regardless of its overall value.

orly

Please check with me for Blammo criteria

You’re ignoring the damage that unbridled fiat currency printing has done to people and the reality is that bitcoin is a reaction to that. Why do you think it’s always bankers warning against the dangers of bitcoin?

Not ignoring it all Kev.

Why do you think it’s always bankers warning against the dangers of bitcoin?

The age-old conflagration of 'bankers' and 'economists' here.

Here's a thought Kev. What makes you think these evil bankers - who can usually spot market trends a lot further in advance than the rest of us and probably have a lot more disposable income - haven't actually bought in at the 2011 and 2013 dips and are now fuelling the speculative rally?

- Status

- Not open for further replies.