nikom court

Player Valuation: £20m

bitcoin is still the best hedge against inflationSo you did say it was a good hedge option?

Ta

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

bitcoin is still the best hedge against inflationSo you did say it was a good hedge option?

Ta

looks like they never got the memo that its all crap,a failure and nobody uses it!

Maybe some of the advocates could help me with something that has puzzled me for a bit. Previously people have said that crypto investments are, or should be, a good hedge against the wider markets as they operate on different principles, and yet now they're plummeting just as quickly as the stock markets, and more so in most cases. What's the deal with that?

bitcoin is still the best hedge against inflation

i dont know what he means by crypto investments,So are you gonna answer Bruce's questions now you have said that?

if you done your googling correctly you would have found out that nobody uses chivo,I wondered when you'd be cheerleading this.

You still haven't said anything about El Salvador centralizing all the wallets under the government's control, which seems far worse to me than your money being held by a bank independent of your government.

Erm, ok. Bitcoin. Ethereum. Go with those two.i dont know what he means by crypto investments,

maybe you can ask him.

ta

no bitcoin isnt correlated to the stock marketErm, ok. Bitcoin. Ethereum. Go with those two.

no bitcoin isnt correlated to the stock market

bitcoin is still the best long term hedge against inflation.

etheriyim is a centralised shitcoin.

any more questions before i have my tea?

Surely if Bitcoin was as you say then people would be piling out of the Nasdaq and into Bitcoin, yet it seems that people are piling out of both.The argument has long existed — some bitcoin supporters have touted the cryptocurrency as “digital gold,” a hedge against inflation and a store of value.

But others point out that bitcoin lately has been trading in tandem with sentiment around the stock market, especially during the past few months, as investors adjust to the Federal Reserve’s plans to tighten financial conditions for the first time in nearly two years, and sooner than previously expected.

that chart is like 10 months old,mate.

Bitcoin is trading in tandem with stocks? This chart shows that relationship as markets face a more hawkish Fed

Bitcoin has yet to stand on its own legs as an inflation hedge as investors adjust to Federal Reserve plans to tighten financial conditions for the first...www.marketwatch.com

Surely if Bitcoin was as you say then people would be piling out of the Nasdaq and into Bitcoin, yet it seems that people are piling out of both.

that chart is like 10 months old,mate.

but when markets go down to spooks short term traders into selling.

also the collapse of a shitcoin to 0 last week caused a big sell off.

you have to accept it is a 13 year old market and there will be some volitility.

sorry i read it wrong 3 years old

So what you're saying here is that El Salvador tried to encourage their citizens to use a centralized bitcoin apo that they would control the keys for but failed because people don't use it?if you done your googling correctly you would have found out that nobody uses chivo,

they cashed out the $30 free dollars and use strike app which is far more user friendly.

hope this quells any fears you had.

Things have not gone to plan, though. Chivo’s launch was plagued with functionality and security issues. Though around half of the Salvadorans surveyed have downloaded Chivo to date, with 40% of those downloads happening in September 2021, around 61% of those have abandoned it after withdrawing the $30 dollar sign-up incentive, the National Bureau of Economic Research found. Only 1.6% of all remittances were received in bitcoins via digital wallets in February 2022, according to El Salvador’s Central Bank.

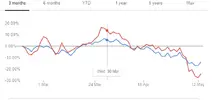

yes there have been similarities with the nasdaq over the last few months,This is the last three months. Seems to be following each other almost identically.

View attachment 165856

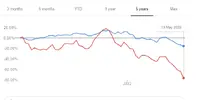

If you look at Coinbase vs Nasdaq over five years, it doesn't really suggest that there is anything there that is a hedge against the vagaries of the market

View attachment 165857

Those similarities would suggest btc is not a good hedge option then, no?yes there have been similarities with the nasdaq over the last few months,

coinbase is shitcoin casino,i dont really have an opinion and nothing to do with bitcoin.