Azza

Player Valuation: £80m

Here we go then, because I obviously have nothing better to do.

I bloody hope not!

Maciek “M.G.” Kaminski

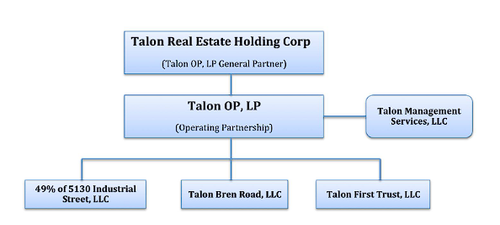

Talon Real Estate Holding Corp.

Accounts for 2016 & unaudited 2017.

Talon Real Estate Holding Corp. 2017 Quarterly Report 10-Q

Security and Exchange Commission SEC Talon Real Estate Holding Corp. Form 10-Qsec.report

To my untrained eyes it looks like the parent company purchases property using loans provided by subsidiary holdings.

^ You'll want to click that to see all the loans.

Talon First Trust, LLC actually defaulted on a massive loan not too long ago when they were taken to court by Gamma Lending Omega, LLC as they didn't pay the late payment fees.

Turns out they ended up losing the property to Gamma as a result of the default and not being able to pay back the loan!

Gamma Lending Omega, LLC v. Talon First Trust, LLC, A18-1205 | Casetext Search + Citator

Read Gamma Lending Omega, LLC v. Talon First Trust, LLC, A18-1205, see flags on bad law, and search Casetext’s comprehensive legal databasecasetext.com

From May 2012

From March 2011

Wayzata's Boatworks sinks into foreclosure

Owner M.G. Kaminski calls the Lake Minnetonka building "my last problem child."www.startribune.com

Well well well.

Maciek Kaminski = M.G. Kaminski = Matthew Kaminski = Matthew G Kaminski = Matthew Gregory Kaminski

November 2010

Still cooking after loss of tax permit

NorthCoast still is serving diners, despite the previous owner's tax troubles.

Losing a sales tax permit can close the door for good on a retail business. But 11 months after having its permit revoked for failing to pay $345,000 to the state, a Wayzata restaurant is still serving scallops and steaks.

That appears to be possible because NorthCoast restaurant changed hands last fall. The previous owner, Matthew Kaminski, sold the restaurant to Brenda Kaminski, according to a September 2009 city of Wayzata memo. At that time, the legal entity that owns NorthCoast changed from Wayzata Northcoast, LLC, which owes the tax debt, to North Coast Wayzata, LLC.

So make a mental note of that. Brenda Kaminski is the wife of Maciek *insert other alias here* Kaminski.

March 2011When reached by Whistleblower last week, Brenda Kaminski said she is the general manager of NorthCoast and said the restaurant was probably on the state's revocation list because of the previous owner.

"I know absolutely nothing, and I should know just about everything, because I'm in charge of opening all the mail and forwarding all the pertinent information," Kaminski said.

Matthew Kaminski, who heads the investment firm Wayzata Capital Management and also goes by the first name Maciek or M.G., did not return a call for comment. Brenda Kaminski's Facebook page lists her as married to M.G. Kaminski.

Wayzata's Boatworks sinks into foreclosure

Owner M.G. Kaminski calls the Lake Minnetonka building "my last problem child."

Now when I first read this I thought Matthew Kaminski must be his son, but it looks like it's actually Maciek himself.

NorthCoast, owned by Kaminski's wife, Brenda, remains open, but the surf-and-turf eatery has had its own challenges. The state Department of Revenue in 2009 yanked the sales tax license of the entity operating NorthCoast for failing to pay a $345,288 tax bill to the state.

A new legal entity now owns the restaurant, but the previous debt has not been resolved, according to the Revenue Department. The state has filed three tax liens against a Matthew G. Kaminski regarding the debt. The state has also filed tax liens against the new entity, NorthCoast Wayzata LLC, for more than $100,000.

Soooo he just created a new LLC under his other name to take ownership of the restaurant even though he already owned tax under the previous LLC.

And as I google different names and LLCs more and more defaults and liens appear.

Here is another under a different LLC.

Byrd, LLC defaulted on two promissory notes that were secured by a mortgage on real property and guaranteed by Byrd’s chief manager. The district court entered summary judgment for the lender after concluding, as a matter of law, that Byrd was in default on its obligation to repay the notes, that Byrd had breached a term of the mortgage by giving another lender a mortgage encumbering the same real property, and that Byrd’s chief manager is liable on his personal guaranty of the notes

In August 2007, Byrd borrowed approximately $2,814,000 from LaSalle Bank, the predecessor-in-interest of RCH Mortgage Fund IV, LLC, the respondent in this appeal Byrd’s chief manager, M.G. Kaminski

In late June 2010, Byrd borrowed $6,000,000 from Tennessee Commerce Bank (TCB). Kaminski, on behalf of Byrd, gave TCB a mortgage that encumbered the same parcels of real property that were encumbered by the mortgage given to LaSalle

Here is another case - https://trellis.law/doc/16207505/SATISFACTION-OF-JUDGMENT

Pear Beta Funding LLC v basically ever single entity they own. They lost and had to repay $234,674.82.

They hired a branding agency to redesign their website... they didn't pay the invoices and got taken to court!

Linnihan Foy Adver., LLC v. Talon Real Estate Holding Corp., A18-0595 | Casetext Search + Citator

Read Linnihan Foy Adver., LLC v. Talon Real Estate Holding Corp., A18-0595, see flags on bad law, and search Casetext’s comprehensive legal database

casetext.com

“On February 15, 2018, the district court issued its order for judgment, holding Talon liable to Linnihan Foy for $19,547.07 as of July 31, 2015, plus interest, costs, and disbursements.” Linnihan Foy Adver., LLC v. Talon Real Estate Holding Corp., A18-0595, 3 (Minn. Ct. App. Mar. 4, 2019)

Just to go back to the building the use to get that $58m mortgage from Gamma Lending Omega LLC in June 2018 they attempted to sell the property 180 E. Fifth St. to First Capital Real Estate for $98m.

Under the agreement, the Company agreed to sell the Limited Liability Company which contained the ownership of the property located at 180 East 5th Street, St. Paul, MN, for consideration with an estimated value of $98,000,000.

It turns out that too broke the terms of the contract they had with Gamma - https://casetext.com/case/gamma-lending-omega-llc-v-kaminski-1?q=Talon Real Estate Holding Corp&sort=relevance&p=1&type=case

Which is why Gamma were able to purchase the property out of receivership.

The Kaminski's still owe Gamma $2,878,245.99 as the sale didn't fully cover the costs of the loan.