Any truth to the suggestion that crypto helped crash SVB’s balance sheet?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Crypto currency (IF banned from CA)

- Thread starter YoboCopter

- Start date

- Status

- Not open for further replies.

DuuuncanHadaPigeon

Player Valuation: £10m

bullish

we are in the disbelief phase, better to buy now or you will be buying my bags during the euphoria phase

A very high point for your average person - $250k per depositor per bank. If as an individual you have more than 250k you can split it between several banks and have full insurance.Cash is covered up to a point, after that you get nothing.

Cash is king until the FCSC says it's not.

Deposit Insurance FAQs | FDIC.gov

www.fdic.gov

www.fdic.gov

Even if you don’t split it the chances that you will ultimately be made whole by either the sale of the assets (depositors are first in line in wind-down), an acquiring bank or the FDIC are high (although not 100% so good money management to split large deposits to stay under the 250k)

DuuuncanHadaPigeon

Player Valuation: £10m

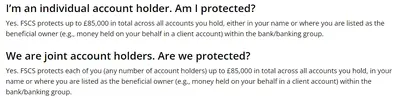

In the UK it is £85k total across all bank accounts.A very high point for your average person - $250k per depositor per bank. If as an individual you have more than 250k you can split it between several banks and have full insurance.

Deposit Insurance FAQs | FDIC.gov

www.fdic.gov

Even if you don’t split it the chances that you will ultimately be made whole by either the sale of the assets (depositors are first in line in wind-down), an acquiring bank or the FDIC are high (although not 100% so good money management to split large deposits to stay under the 250k)

Not SVB as far as I know but played a part in the closure of Signature which fell the same weekend and also SilverlakeAny truth to the suggestion that crypto helped crash SVB’s balance sheet?

Risky Bet on Crypto and a Run on Deposits Tank Signature Bank

Regulators said keeping open the 24-year-old institution, which held deposits from law firms and real estate companies, could threaten the financial system’s stability.

Surprised they haven’t done the same as FDIC and split it across banks.

One thing is for sure, I will not be buying your bags!bullish

we are in the disbelief phase, better to buy now or you will be buying my bags during the euphoria phase

Not SVB as far as I know but played a part in the closure of Signature which fell the same weekend and also Silverlake

Risky Bet on Crypto and a Run on Deposits Tank Signature Bank

Regulators said keeping open the 24-year-old institution, which held deposits from law firms and real estate companies, could threaten the financial system’s stability.www.nytimes.com

Doing any sort of loan to Saylor with his history was always very risky

Matt Levine from Bloomberg's newsletter has a good opener

A decent rule of thumb is that all cryptocurrency exchanges are doing crimes, and if you’re lucky your exchange is doing only process crimes. Today the US Commodity Futures Trading Commission sued Binance Holdings Ltd., Changpeng Zhao’s big crypto derivatives exchange, for letting Americans trade crypto derivatives. There are no accusations that Binance is stealing customer money, or even taking big risks with it, which makes Binance look better than some other crypto exchanges I could name. There are … look, there are not no accusations that Binance is laundering money for terrorists or secretly trading against its customers, but there are relatively few accusations like that; again, as crypto exchanges go, that’s pretty good.

YoboCopter

Player Valuation: £50m

Aslong as it goes to the moon i dont care!!!Matt Levine from Bloomberg's newsletter has a good opener

DuuuncanHadaPigeon

Player Valuation: £10m

Doing any sort of loan to Saylor with his history was always very risky

Saylor is an idiot who fundamentally does not understand BTC as proven by his recent posts about mining.

Zatara

Player Valuation: £100m

Matt Levine from Bloomberg's newsletter has a good opener

I think it makes him look like an utter fool.

DuuuncanHadaPigeon

Player Valuation: £10m

There are a handful of exchanges that you could trust. Wash trading & scam wicks are commonplace. Crypto is not about having to trust middlemen though, so no need to use an exchange other than to on/off ramp. Not your keys not your coins.I think it makes him look like an utter fool.

- Status

- Not open for further replies.