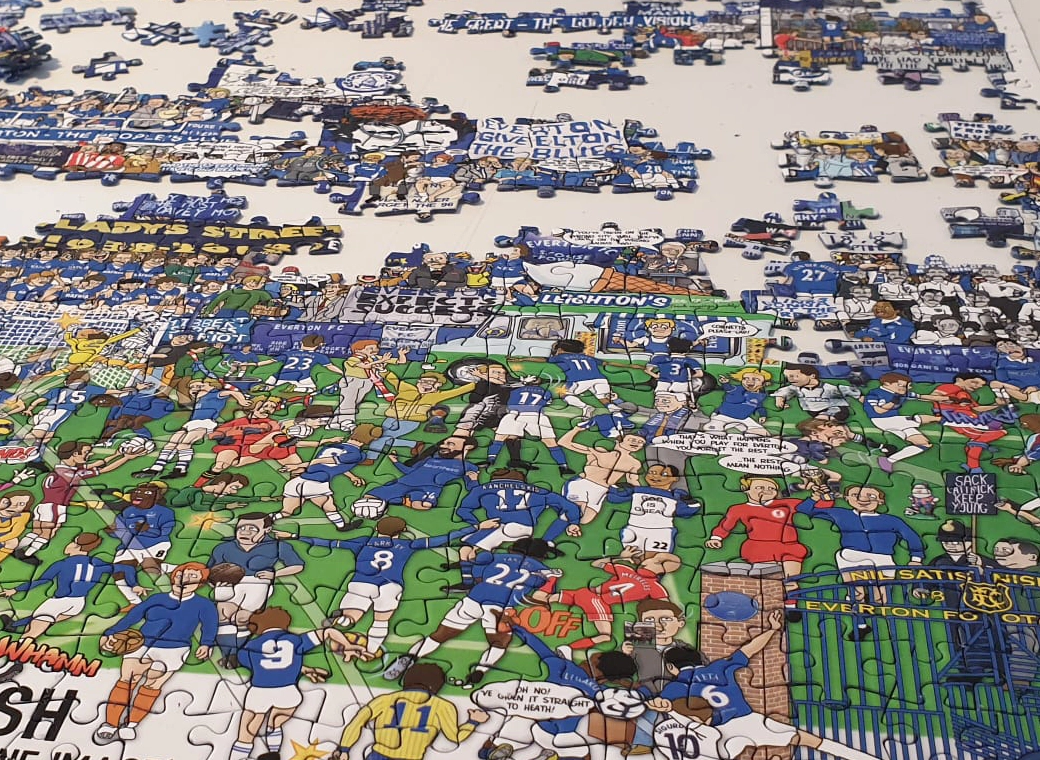

bizzaro

LOVE GOT JUST THE WAY IT IS #ALWNV

Personally I think the inference from The Blue Union is that a Board containing Bill, Jon Woods, Mr Moshiri's representative and our CEO Robert Elstone does not represent sufficient change, or at least the change they expected when Mr Moshiri's purchase of shares was announced.

Oh Esk. Where do we even start with these things???

Remember. You're talking to the person presently obssessed with trying to work out every facet of what Mr Moshiri is planning for us.

As you well know.